Today's Word Is: Uncertain

PeddiNews: John Cross Update

No word better describes the current state of both the general economy and the construction industry economy than uncertain. Unlike most words with multiple definitions, every meaning of the word uncertain applies to our current situation. We are uncertain about the present, the future, the facts, the timing, and what all of this means to the construction market and our businesses.

What we do know is that the construction sector lost 975,000 jobs in April. This decrease of 13% mirrored a similar decrease in overall employment of 20.5 million jobs. All indicators point to even further losses during May. The national contractor organizations (AGC and ABC) both report a growing number of projects being put on hold or canceled with the number of projects being put on hold or canceled by owners and developers now exceeding the projects put on hold due to either local government shutdown orders, supply chain issues or absenteeism.

The signposts of the future identified in last month’s article all show vertical, downward lines. Not a surprising trend when the economy was frozen by stay-at-home orders and only essential businesses were allowed to stay open with no clear view to a future that could only be summarized with one word, “uncertain”.

Alan Greenspan, former Chairman of the Federal Reserve System, once said “The one thing all human beings do when they are confronted with uncertainty is pull back, withdraw, disengage, and that means economic activity, which is really dealing with people, just goes straight down.” This may result in a spiral where mounting uncertainty feeds a loss of consumer confidence which feeds more uncertainty and on and on.

Are we there yet? Probably not. The University of Michigan conducts a Consumer Sentiment Survey on a monthly basis. Unlike many surveys that are conducted at the end of each month, the Consumer Sentiment Survey is conducted on the 15th of each month. Consumer sentiment dropped from a near-record high of 101 on February 15th to 89.1 on March 15th before plunging to 71.8 on April 15th. But even the 71.8 on April 15th was significantly higher than the level of consumer sentiment of 55.3 at the beginning of the Great Recession in November of 2008. And surprisingly on May 15th, the index rebounded slightly to 73.7. The results of a single month do not indicate a trend, but the fact that the index did not dip to the same low as in November of 2008 and showed even a slight upward bounce this month indicates a resiliency and optimistic attitude among U.S. consumers.

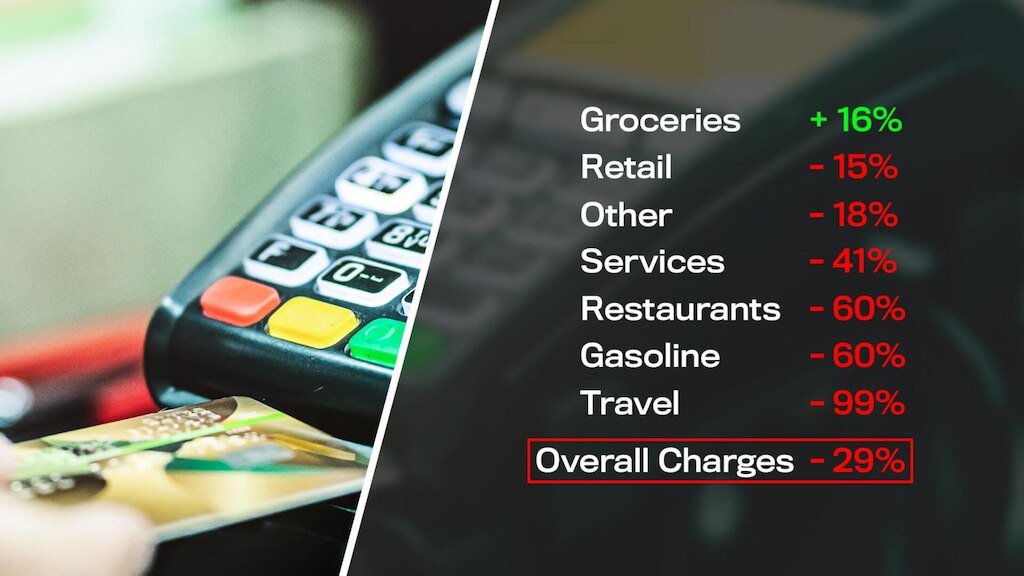

Consumer spending accounts for 70% of U.S. GDP. The preliminary report for the 1st quarter of 2020 indicated that GDP fell by 4.3% while personal consumption fell by 5.3%. In looking at these numbers it should be noted that the level of consumer spending in the first half of the first quarter (January 1 through February 15) was not affected by the COVID-19 pandemic. Discover Card in late April released data on how the use of their credit cards by consumers had changed compared to pre-pandemic purchasing (the data reflects charges on Monday, April 20th):

But what about the uncertain future? Economists looking at both the economy in general and the construction economy in particular are beginning to share their thoughts on how the impacts of the pandemic will play out in the marketplace. And, not surprisingly, their opinions and predictions vary greatly.

The 6th century Chinese poet Lao Tzu is credited with saying, “Those who have knowledge don’t predict. Those who predict, don’t have knowledge.” Rather than provide a specific prediction of the future during this time of uncertainty, it is best to follow his advice and identify instead a cone of uncertainty. Uncertainty cones are a familiar concept even if they are not referred to in those terms. I live on Lake Michigan which is experiencing high water levels. The Corps of Engineers published a monthly forecast of water levels looking out 6 months that include a range of water levels that gets wider the further out from the current month it gets. In the same way hurricane forecasters project the location of landfall several days in advance not as a single point, but across a broad area of the coast that narrows the closer the hurricane gets to the time of the actual landfall.

There are three potential scenarios that define the cone of uncertainty for the recovery of the construction economy from the impact of the current pandemic. The optimistic scenario assumes that there will be few new project starts during 2020. Those projects that do start will be ones that already have contracts awarded. Bidding activity will be low or non-existent with the exception of projects in the warehouse, pharmaceutical, data center, government and public education sectors. Industrial projects will mirror this trend evidenced by nearly 40% of planned projects in 2020 already being cancelled or put on hold. However, in the 4th quarter of 2020 the economy will, as President Trump predicts, coming roaring back as a result of the development of a vaccine or the limitation of community spread of the virus. This rapid economic rebound will not initially be felt by the construction market as even a rapid growth in the number of workers employed and GDP will not push employment to the pre-pandemic levels required to generate an immediate increase in project demand. That delayed demand and the lag between the beginning of design activity and start of actual construction will depress the 2021 market during the initial quarters of 2021 to 2020 levels with growth resuming in later 2021 and continuing into 2022. The administration and many business owners are embracing this optimistic scenario. This is not surprising as business owners are by nature optimistic individuals who anticipate growth and success rather than contraction and failure.

At the other extreme within the cone of uncertainty is the pessimistic scenario. This scenario envisions a lengthy delay in the development of a vaccine, the number of cases spiking across the U.S. and a cycle of business openings and closings. The result is that the domestic economy falls off a cliff dipping to Great Recession levels and fails to rebound. This view was given support in mid-May when J. P. Morgan Chief Investment Officer, Bob Michele, predicted that it will take 10 to 12 years after the pandemic ends for U.S. employment to get back to its pre-pandemic level. When asked if it would be as simple as “turning the lights back on” he responded, “No, it’s not that simple…it’s going to take years, or longer to get back to where we are, or where we were.” In this case, construction activity drops to or below the Great Recession levels of 2009 and 2010 and stalls out for at 3 to 4 years followed by a slow climb lasting the rest of the decade before returning to 2019 levels. This is not a reliving of the “Great Recession” but a “Greater Recession” to borrow a phrase coined by Forbes magazine citing a greater drop in retail sales, industrial activity, manufacturing demand, oil prices and employment than that of the Great Recession. This view is being embraced by some economists who are notoriously pessimistic as they practice what is often referred to as the “dismal science”.

So what falls between the optimistic and pessimistic scenarios in the middle of the cone of uncertainty? The middle of the cone of uncertainty isn’t the most likely outcome; it is simply another alternative that should be considered. It assumes that the pandemic will be with us until a vaccine is developed and widely distributed in the first two quarters of 2021 until which time the general public practices wise social distancing measures. In the interim, there will be spikes in the number of cases in limited areas of the country but that those spikes will be controllable with testing, tracking and regionalized stay-at-home measures. Just as in the most optimistic scenario, there will be few project starts in 2020. But in this scenario design activity will also be very limited during the first two quarters of 2021, delaying an upswing in construction starts until 2022. During an earlier recession while he was still just a real estate developer, Donald Trump was asked why he cancelled several projects that were about to start construction. His response was simple, “you don’t start projects during a downturn”. A reasonable and understandable sentiment even if it resulted in the delay of a construction recovery. This scenario also takes into account the impact of depressed oil prices that have resulted in a decreased demand while production has increased (even the current agreement between Saudi Arabia and Russia to lower production lowers production less than the reduction in global demand that has been experienced because of the pandemic). However, unlike the pessimistic scenario, employment and economic activity pickup quickly as the pandemic is controlled, resulting in a return to pre-pandemic levels in the 2024 to 2025 time frame.

Which of these scenarios is most likely? Because of all the uncertainties involved that is a prediction that each of us needs to make on our own. That prediction will be driven by our sense of optimism or pessimism. Personally, I pride myself by claiming to be a realist so I tend to come down in the middle in most situations, but that is not a prediction. As we move through the next several months it will be critical to continue to watch the signposts discussed last month (employment, GDP in dollars, the Architectural Billing Index, the Dodge Momentum Index and Consumer Sentiment) to narrow the cone of uncertainty and better understand what the future for construction will look like.

As the Nobel Prize winning physicist Niels Bohr said, “prediction is very difficult, especially if it’s about the future.” His statement is all the more true when we are dealing with an uncertain future.

John Cross, PE has tracked construction activity for 20 years. Until his retirement in 2018 he served as Vice President of Market Development for the American Institute of Steel Construction (AISC) and authored a regular column on the impact that economic trends have on the structural steel market for Modern Steel Construction magazine. He can be reached via email at crosswind.consult@gmail.com.

Enter Today for a Chance to Win FREE Machinery

Gift cards and other Peddinghaus merchandise included

46331 mobile

TO

46331

WINNER

Normal text message rates apply. Text “STOP” to opt out. Text “HELP” for help. Up to 3 msgs / month. Terms https://www.peddinghaus.com/terms/1